Rather than owning gold coins or bars outright, you may be part of a pool of investors who all have an interest in large 400 ounce gold bars. This means that you own a part or parts of a bar and your holding is not capable of being separated from that of other investors. As a result it is not possible in most circumstances to easily take possession of your gold. If you are a holder of an ETF (an Exchange Traded Fund), you own a share in a fund that has an interest in a pool of gold bars and you most likely don’t even have direct access to your gold!

Many existing digital gold, digital bullion vault providers and indeed gold ETFs operate on a pooled gold basis and mix or co-mingle bullion of different clients in individual accounts. While they claim their bullion is allocated, frequently that is only half true and what they are offering is pool allocated and, in some cases, unallocated gold. This means that you and all other investors involved have a claim on a stock of gold bullion which may be in many different forms. Again in this situation you most often do not have a claim on specific coins or bars of gold.

We have always stated that when owning gold to hedge systemic risk, one must not simply seek to invest in, or rather own physical gold, but rather be sure to own the right gold, in the right form, in the right place, and in the right way in order to ensure that one is protected against these worst-case scenarios.

Gold is financial insurance and a hedge against risk. It is a proven safe-haven asset but only if owned in the safest of ways.

"What I like about Direct Access Gold is that it entitles precious metals investors to buy, sell, move or gain access to their gold during a worst case scenario. This is extremely important!"

Since being founded in 2003, GoldCore has transacted over $1 billion dollars worth of precious metals on behalf of our clients.

We have been trusted by over 16,000 private, pension and corporate clients.

And we have facilitated the purchase, sale and storage of gold, silver, platinum and palladium on behalf of residents in 140 different countries.

We have won awards for our precious metals research and are regular contributors on CNBC, CNN and Bloomberg TV.

We remain at the forefront of development and technology in the precious metals industry and pride ourselves on our mission to continue to ensure that our clients own and hold gold in the safest way possible, in the safest jurisdictions in the world because we believe that to own gold as financial insurance, that financial insurance needs to be available, accessible and actionable.

"I’ve used GoldCore’s services many times to buy gold and silver and to store gold and silver. I’ve found their prices competitive and their service excellent."

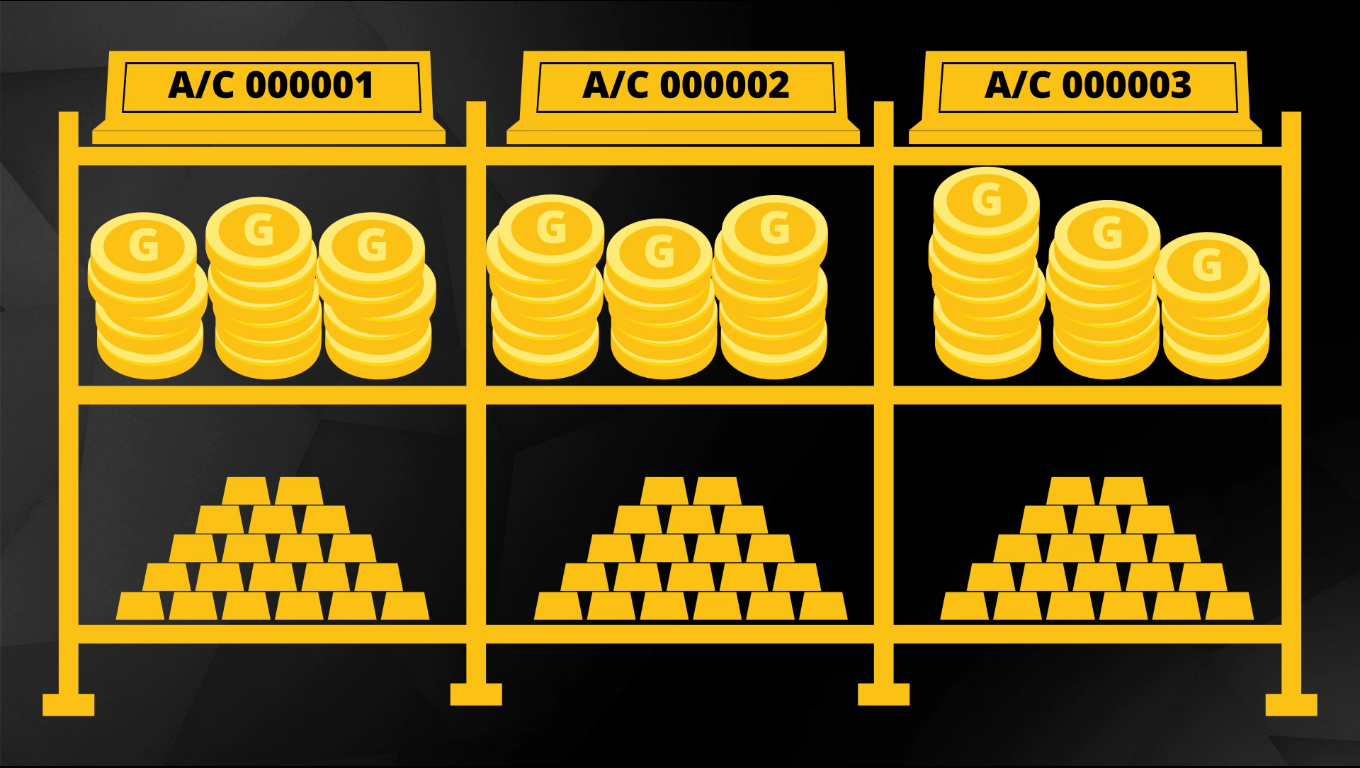

All of GoldCore’s clients stored bullion coin and bars assets are owned in an allocated and segregated manner. This means that each client has individual ownership of his or her bullion holding and each retains outright ownership of their coins and bars. Each client's holding is kept separate from all other clients, with their dedicated account number and their own dedicated space in a high security, specialist bullion vault. Clients can visit the vault in person and audit and verify their specific holding and records of coins and individually numbered bars.

Every Direct Access Gold client is protected by the Direct Access Gold Contingency Agreement. An agreement that empowers them, in the event of certain circumstances, to make direct contact with our vault provider and initiate access to and control of their bullion. They can remotely direct their bullion to be delivered to them in person or have it shipped to another secure vault of their choosing. They may also want to transfer it to another bullion dealer for sale or in certain circumstances they may want to present in person at the vault and collect their gold.

Should GoldCore, or our domain, suffer any consequential loss as a result of banking, political, technological, natural disaster or other systemic risk type events, the Direct Access Gold Contingency is activated. This offers a layer of protection to precious metals investors that is not available from any other precious metals investment vehicle. And it massively reduces the risk to you, the investor, as it reduces the effects of corporate, systemic and geopolitical and national risk to which you are currently exposed.

Following the specified validation process the client can communicate directly with the vault and their instructions are actioned.

"Not only do they let your gold be allocated and segregated within their secure vaults, but they also let you have access at any time."

So if you have invested in gold as a hedge against the uncertain, isn’t it time that you ensured that you are owning and holding it in the safest way possible?

GoldCore’s mission is simple, to ensure that their clients own and hold gold in the safest way possible, in the safest jurisdictions in the world because we believe that to own gold as financial insurance, that financial insurance needs to be available, accessible and actionable.

So stop inviting more risk into your investment portfolio and instead own gold in the most safe and secure way.

If you want to avoid these very real risks of being unable to take delivery of your gold when you want, contact our team today to talk about direct access gold.